To setup sales tax on pickup or delivery items, first ensure your pickup or delivery are marked as taxable, then input your tax.

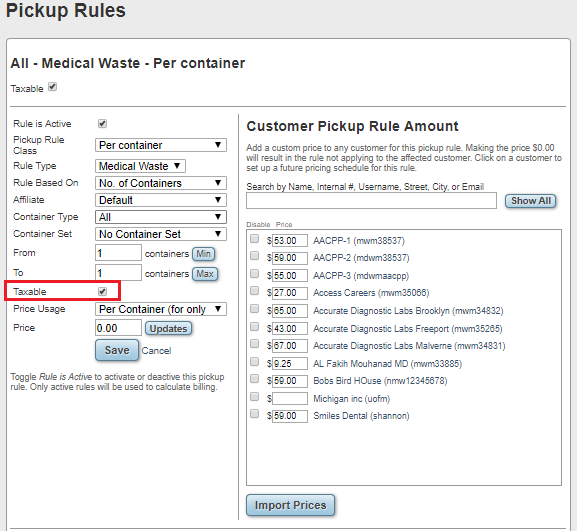

The first step to setting up sales tax is to navigate to the pickup or delivery rules that pertain to taxable activity and ensure that they are marked Taxable.

- Log into the Affiliate Portal and click on the Billing tab

- Scroll down to pickup or delivery rules

- Select the corresponding rule class (at the top of page)

- Click Edit next to the respective rule and check the Taxable box

After the pickup or delivery rule or rules that you'd like to be taxable are marked taxable, now you'll need to set up the percentage fee.

To set up the percentage fee:

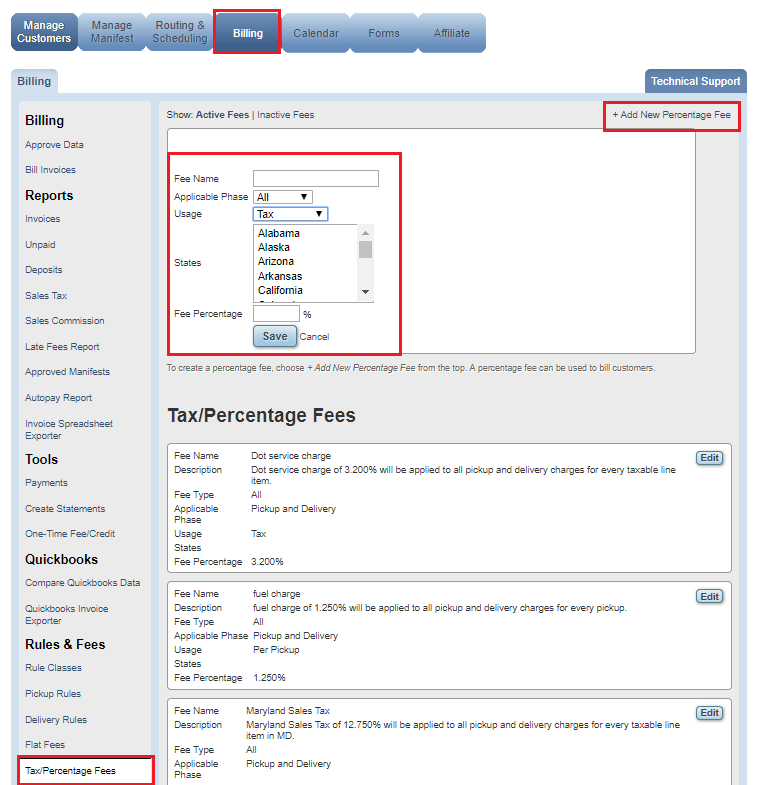

- Navigate to the Billing tab

- Click Tax/Percentage Fees

- Click "+ Add New Percentage Fee"

- Enter in the name of the tax in the Fee Name field

- Choose the applicable phase of the tax (pickup, delivery, or both)

- Change the Usage field to "Tax"

- Select the State that your tax applies to. Keep in mind, this will be determined by the service address.

- Lastly, enter the Fee Percentage and click Save